Sustainability is an integral part of the corporate strategy of Novavest Real Estate AG. We are convinced that incorporating sustainability criteria into the value chain is crucial for the success of our business activities. We see sustainability as our fiduciary duty to create long-term value for our investors. We apply our integrated sustainability approach to the development, renovation, and management of our real estate investments, carefully balancing entrepreneurial, environmental, and social aspects.

Our established governance through our Board of Directors and the Executive Board ensures the transparent implementation of our sustainability strategy. This enables us to live up to our stakeholders’ expectations. In addition to established ESG goals, we value the development of our employees, satisfaction, health and well-being. Taking social and regulatory developments into account, we make a significant contribution to housing for both young and elderly people, resource conservation, and climate protection while ensuring sustainable and value-oriented growth for our investors.

Key topics

With the help of the materiality analysis, Novavest Real Estate AG prioritizes relevant topics and ensures the strategic management of sustainability objectives. The key topics reflect our identity and the expectations of our stakeholders.

Novavest Real Estate AG has identified the following key topics and represented them in the materiality matrix below. To ensure a balanced assessment, relevant economic, environmental, social, and governance aspects have been considered.

UN Sustainable development goals

The United Nations Sustainable Development Goals (SDGs) play a significant role in the real estate sector, as they define a global framework for sustainable development and address challenges such as environmental and resource protection, social justice, and economic development. By implementing the SDGs, Novavest Real Estate AG can make a positive contribution to the environment and society while achieving long-term economic benefits and risk minimization.

We aim for sustainable and profitable growth while managing our business responsibly, ensuring good working conditions, communicating transparently and managing risk adequately.

We are committed to developing sustainable cities and communities, contributing significantly to sustainable living spaces, and designing and developing attractive neighbourhoods that promote urbanity and connectivity.

We consistently work to promote sustainable management and efficient use of natural resources to reduce waste and contribute to circular economies and sustainable value chains.

Prudent measures to optimise energy efficiency, reduce climate-damaging CO2 emissions and expand renewable energies are key aspects of our environmental goals.

We are convinced that we can reach our ambitious economic, ecological and social goals only by placing our trust in our partners and working towards specific objectives. In particular, our engagement with investors, tenants and other stakeholders is a key success factor in our business activities.

Strategy, measures and goals

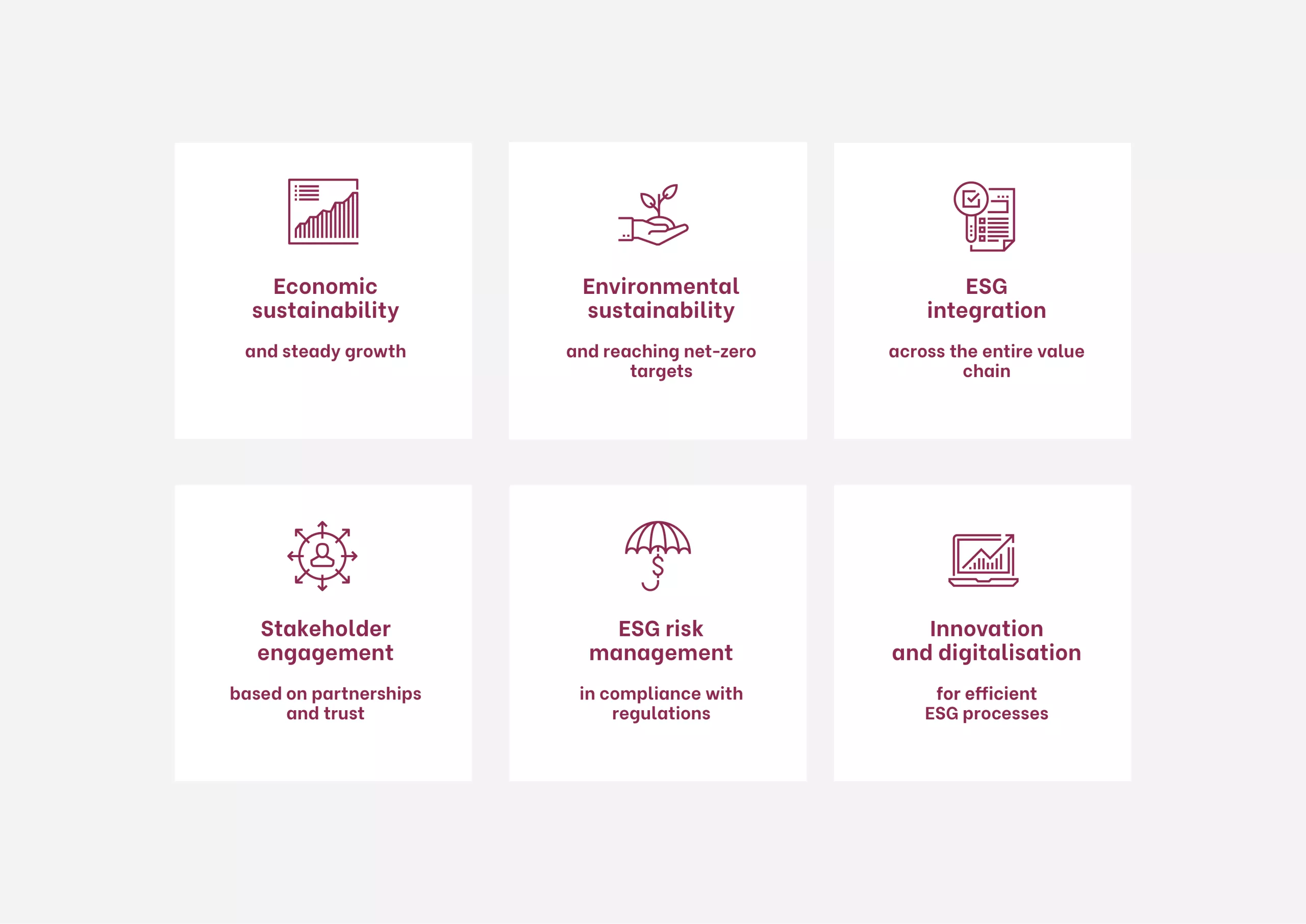

Our comprehensive sustainability strategy aims to incorporate the key issues for developing our business activities in the long term and includes the following:

Economic sustainability

Ensure steady growth and profitability in all business areas and real estate portfolios by means of optimal risk-return profiles and appropriate diversification.

Environmental sustainability

Focus on optimising energy efficiency and reducing CO2; use more renewable energies and conserve resources to reach the net-zero climate target by 2050.

Integration of ESG

Include sustainability criteria in the value chain of all business areas to implement all aspects of the sustainability strategy.

Stakeholder engagement

Maintain a dialogue with all stakeholders.

ESG risk management

Consider sustainability risks to minimize potential value losses from physical environmental and climate-related transition risks.

Innovation and digitalisation

Promote innovation and digitalisation to optimise efficiency and productivity, increase competitiveness and achieve optimal resource efficiency.

Our overarching sustainability goals:

- Achieving the net-zero climate goal by 2050

- Optimising energy efficiency by 45% by 2030

- Reducing CO2 emissions by 45% by 2030

- Expanding renewable energy by 30% by 2030

- Achieving 30% building certification by 2030

- Reaching 100% ESG data transparency by 2030

Our sustainability actions and performance results*:

- Implementation of operational optimizations for approximately 20% of the properties

- CO₂ performance approximately 20% lower than the REIDA CO₂ benchmark

- Completion of a new construction project certified by Minergie

- Portfolio optimization through centralized electricity and energy procurement

- Participation in the annual PRI reporting

*Related to reporting year 2024

Memberships and ratings

Novavest Real Estate AG is a signatory of the UN Principles for Responsible Investment (UNPRI), the leading investor initiative for responsible investing.

Novavest Real Estate AG participates in the Global Real Estate Sustainability Benchmark (GRESB), the leading ESG standard for real estate investments, on behalf of its managed real estate funds and advised investment foundations.

Novavest Real Estate AG participates in the Swiss Sustainable Real Estate Index (SSREI), a leading ESG standard for assessing the sustainability of the Swiss real estate portfolio.

Novavest Real Estate AG participates in the Real Estate Investment Data Association (REIDA), a leading energy and CO2 standard for assessing the environmental performance of the Swiss real estate portfolio.