Portfolio

Investment properties are at the heart of the portfolio.

Repurposing and renovation projects and developed building land also complement the portfolio.

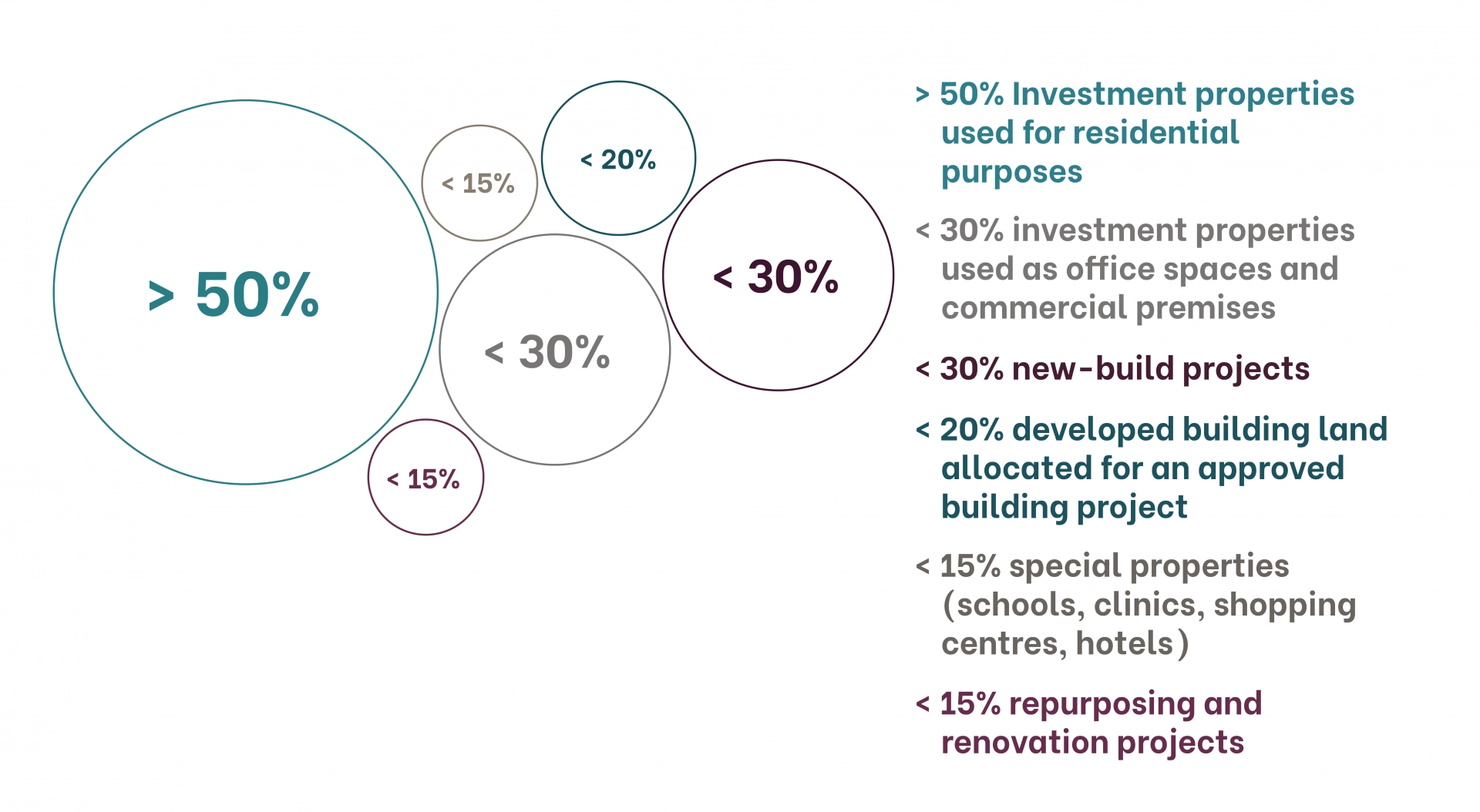

Investment properties make up the bulk of the portfolio. And the focus is on the management and development of properties used exclusively for residential purposes (rental apartments) and living space for the elderly generation (senior residences, care facilities). The share of rental income from residential use shall strategically account for at least 50% of total target rental income. New building projects can account for up to 30% of the most recent property portfolio value (six-monthly evaluation), with the option of also building residential properties to be sold as condominiums.

Up to 15% of the most recent property portfolio value can be invested in special properties, such as schools, clinics, shopping centres, cinemas, hotels and industrial facilities. Up to 20% can be invested into independent and permanent rights entered into the land registry or into developed building land allocated for an approved building project. And up to 15% of the most recent property portfolio value can be invested into properties allocated for approved repurposing or major renovation projects.

Strategy

Opportunities are a stepping stone to an attractive location.

Investment focus

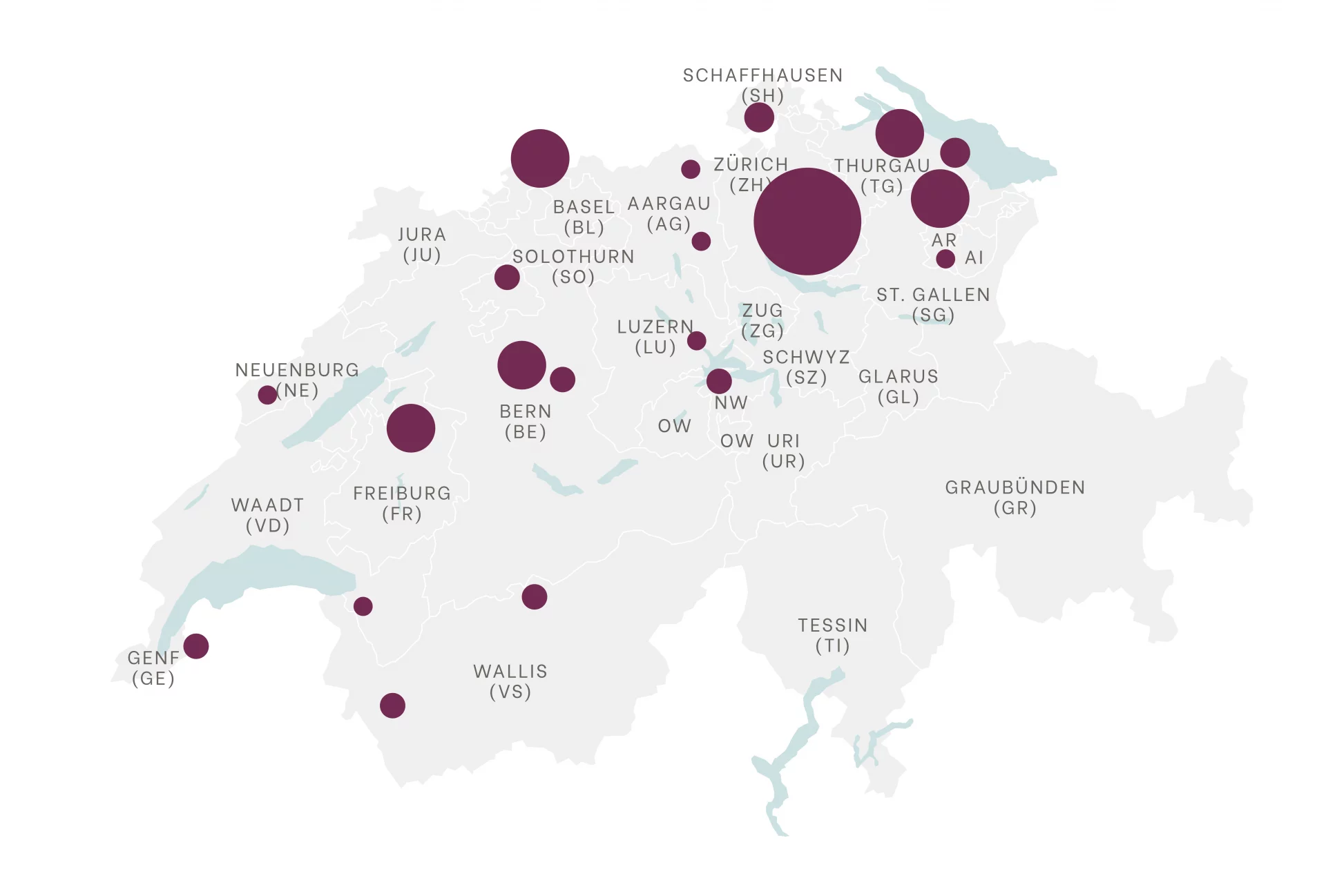

The focus is on properties, mainly existing properties, throughout Switzerland. In the case of purely residential properties, these should be located in the cities or in conurbation areas and/or with good public transport links and easy access by private motor vehicles. For senior residences and care facilities, the properties can be located either in urban or in rural regions of Switzerland.

Target returns for acquisitions

Confidence is a stepping stone to investment success.

When acquiring properties, the target returns for investors should reflect the market and risks over the long term. The market and risks can be assessed by considering how attractive a location is, the quality of the property, the different usage options, sustainable development opportunities, the lease length and the tenants’ credit rating. Returns should also be optimised through repurposing, construction and property development projects.

- All

- Residential properties

- Residential/commercial property

- Commercial properties

Project

St. Gallen (SG)

Rorschacherstrasse 135

This development project in the Eastern part of St. Gallen involves three formerly detached buildings (see first image) that were demolished. The resulting gap between two other investment properties also owned by Novavest Real Estate AG (residential/commercial property at Rorschacherstrasse 123, 125, 127 and commercial property at Rorschacherstrasse 139/Helvetiastrasse 27) can be filled with a new five-storey building. Various commercial premises will be built on the ground floor and 69 studios and rooms on the upper floors.

Project realization is between 2021 and 2024.

Development project for a modern residential/commercial property

Plot size

1,640 m²

Total rentable space

The plans include up to around 2,150 m² to be rented in the future. According to the schedule, the apartments and commercial spaces should be ready for occupation by autumn 2024.