Profile

Both knowledge and growth take time. The wealth of expertise in property management at Novavest Real Estate AG’s disposal is based on many years of experience and in-depth industry insights. It is that knowledge that provides the foundations for the company’s proactive approach and strategic direction.

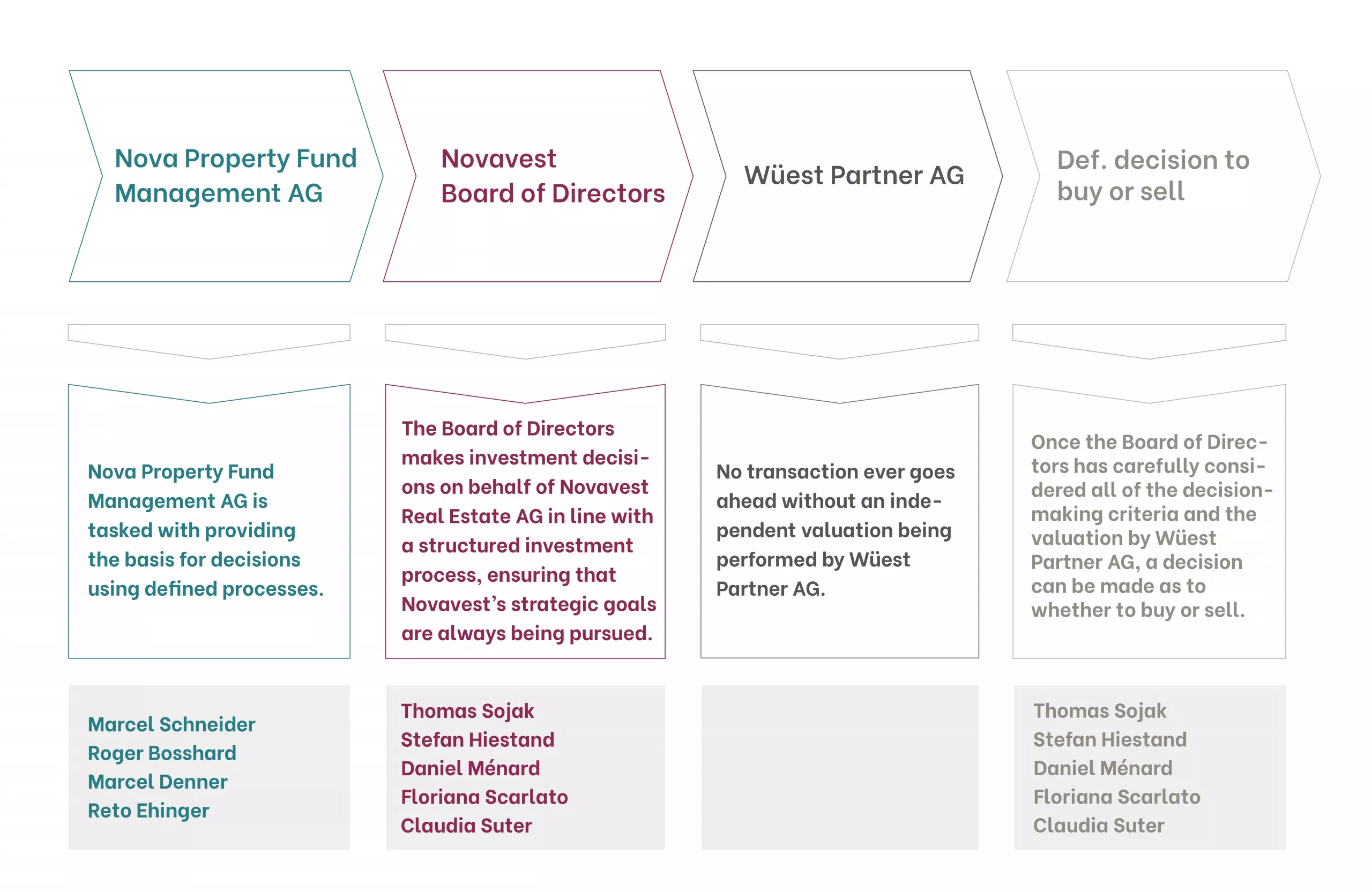

Profitable business dealings are the main priority – much to the benefit of investors. Our carefully structured processes deliver efficient and transparent results. The team at Nova Property Fund Management AG are also on hand to support us with their impressive expertise in property development and management.

Our broadly networked team has successfully implemented many projects, enabling us to guarantee innovative, economical and sustainable solutions.

Philosophy

Goals are a stepping stone to the future.

Novavest Real Estate AG draws on great strengths to reliably maximise returns – our expertise, our experience and our professionalism. This allows us to offer investors the best chance they have of achieving their goals.

These include lasting success and sustainable capital and revenue growth.

It makes sense to include Novavest Real Estate AG in your plans for the future. We enable investors to tap into new opportunities by getting involved in a professionally managed portfolio of properties, invested throughout Switzerland. Our competent property management ensures active cashflow and sustainable income for investors, independent of fluctuations in value.

Ongoing risk management is also performed at every step of the entire investment process. Trust may be good but control is better, and that’s why we are all about transparency when it comes to the ongoing optimisation of the portfolio. For a successful future powered by Novavest Real Estate AG.

Services

Action is a stepping stone to profit.

Novavest Real Estate AG is proactive in its management of the portfolio. It checks the profitability of properties, „evaluating“ them against one another. The weakest properties are sold and suitable new properties are acquired and added to the portfolio. Our ongoing risk management strategy runs through all our processes alongside this constant evaluation of the portfolio.

Property selection and acquisition

Property selection

- Extensive network of contacts made up of property sellers and buyers, brokers, etc.

- Own development

Property prioritisation

- 5-point check

- Strategy compliance

- Estimated expenditure and profit calculations

- Main decision

Property acquisition

- Objective independent evaluation

- Risk analysis

- Portfolio compliance check

- Binding offer check and approval

- Transaction

Property management

Property planning/implementation

- Budget plan

- Development projects (repurposing etc.)

- Liquidity plan

- Project approval

- Implementation

Property management

- Definition of renovation cycle

- Consideration of sustainability aspects

- Optimisation of revenue base

- Implementation

- Controlling

Property risk management

- Identification of vacancy rates/relet opportunities

- Identification and reduction/elimination of bulk risk

- Risk overview for individual properties

- Scenario analysis

Property marketing

Property portfolio screening

- Market observation

- Internal property benchmarking

- Performance attribution evaluation

- Risk analysis within the portfolio context

- Regular checks on strategy compliance

Property sale

- Preparation work

- Allocation of minimum sale price

- Creation of investor dossier

- Definition of sale process

- Binding offer check and approval

- Transaction (best execution)

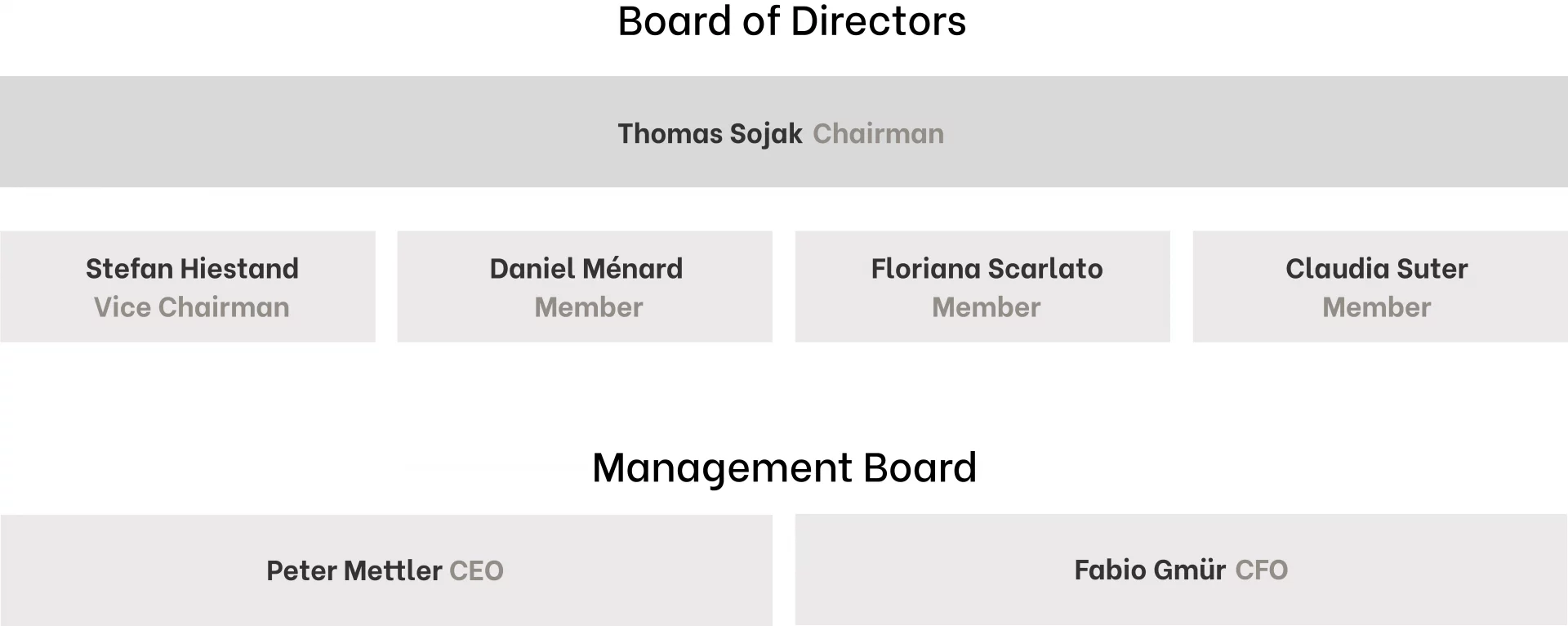

Governing bodies